Money SMARTS begins with setting goals with SMARTS, both short-term and long-term goals. The course moves on to banking tools that can help with our financing. Strategies for budgeting and savings are discussed and we develop an actual family budget. Together, we look at credit, credit cards, consumer rights, how to read a credit report and fixing our credit. The course concludes with Investing for the Future with savings plans for education, starting a business, homeownership and retirement plans. The course is designed for individuals or families with up to moderate income and gives a good overview of personal and family financial management strategies.

The Money SMARTS course is free! The course is eight hours long and is delivered in a light and engaging manner. The binder and handouts become a toolkit personalized for your family. The course is presented by ALU LIKE, Inc., and sponsored by the State of Hawai’i Department of Human Services.

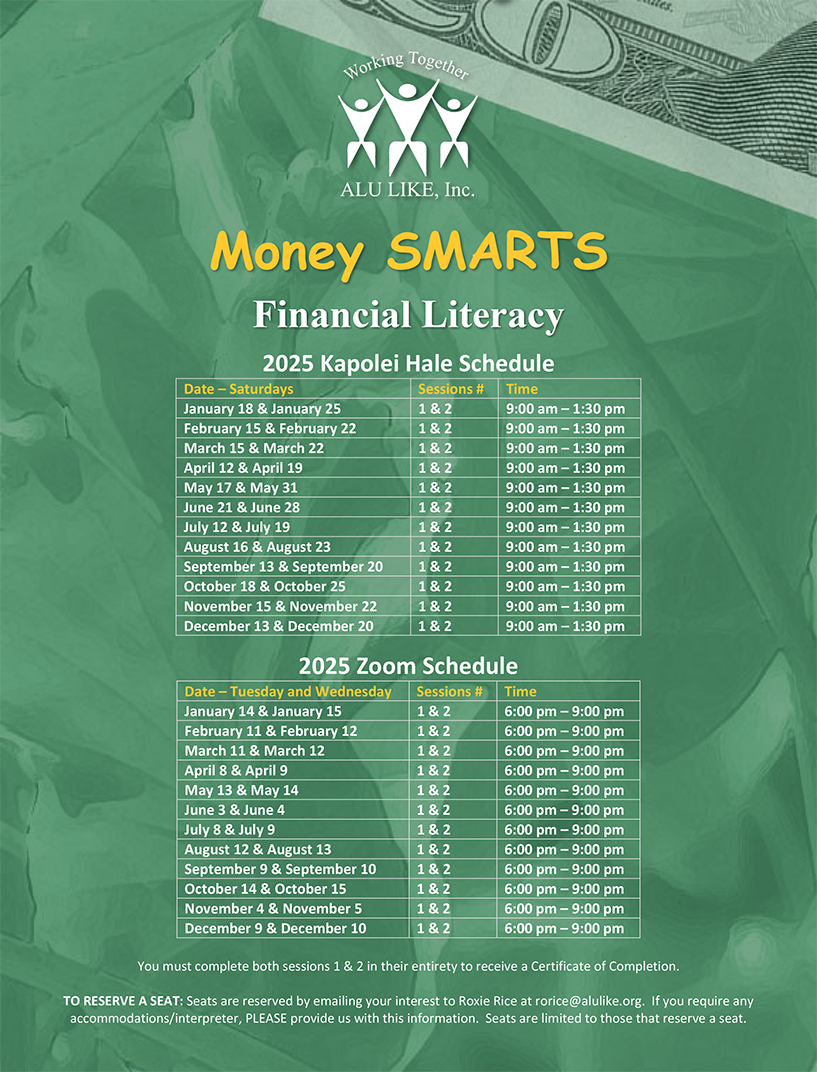

TO RESERVE A SEAT AT KAPOLEI HALE

To register, please contact Roxie Rice at (808) 892-3357 and leaving a message with your name and the names of all attendees, or send an email to rorice@alulike.org with the same information. Thank you!

ZOOM Option

To register for a Zoom online class, please click below:

You will receive the Zoom Link for the class after registering and being approved. A working computer with WI-FI and Zoom access for the duration of both sessions is required. Class may be canceled if less than three persons are interested.

Topics include

- Setting Goals

- What is a GOAL?

- The 6 things you must have to set successful goals

- Banking Tools: the basics on checking and savings accounts

- Budgeting and Saving

- What is a budget?

- Ways to Save

- Creating a Family Budget… and Sticking to It

- Credit

- Credit Card Debt… and how to get out

- Credit Reports and how to read them

- How to improve your credit

- Planning for the Future

- Insurance

- Starting a business

- Planning for education for the keiki

- Homeownership

- Retirement

Frequently Asked Questions (FAQs)

Yes.

Yes.

Rent-to-Work prefers that people take the in-person format of Money SMARTS (Dole Cannery, Kapolei Hale, or any in-person class offered at various agencies around O’ahu). However, on a very limited basis, some individuals may qualify to take the Zoom format in place of in-person classes (people with mobility impairments, single parents, parents of children under kindergarten age, residents of DV shelters). Please indicate on your registration form if you have a Rent-to-Work eligibility request.

Yes.

They are 4 hours long, for 2 class sessions (Class 1 & Class 2).

The certificate of completion verifies that you completed both Money SMARTS class sessions. This may be presented to Rent-to-Work caseworkers, landlords, or other social service professionals to assist you in your personal and financial endeavors.

In-person Money SMARTS workshops are available on a limited basis, as we are already providing consistent workshops for many agencies around O’ahu most days of the year. Please reach out to Roxie Rice at rorice@alulike.org to inquire. Money SMARTS classes are 2-sessions, lasting 3-4 hours per session. All we need is a reasonably quiet space, tables and chairs, and a white board if you have one available. Everything else will be provided for you.

Money SMARTS is intended for adults only (ages 18 and above). If you are a nursing mother, yes, your very young, non-walking infants may attend alongside you. Children who do not require breastfeeding are not permitted to join classes at this time as it can create a significant distraction for both the parent of the child, other adult participants, and even for the class instructor. Furthermore, ALU LIKE, Inc. cannot be held liable for any injuries to children or property damage caused by children at our in-person workshops. Mahalo for understanding. The Zoom Online class format may best suit your needs if you are a parent.